FreeMarks

A better engineered cryptocurrency

Terms and Conditions for the Pre-sale of

the FreeMark Digital Currency

The sale of FreeMarks is not available to persons who reside in jurisdictions where its sale is unlawful.

Please expand and read the following sections

The following are forward-looking statements, provided in earnest, yet no one can predict the future.

The FreeMark Price Will Be Automatically Pegged, Thus Stable

The FreeMark is an asset-backed stablecoin that maintains its stability using digitally enforced, automatic-pegging to the 6-month moving average of a weighted basket of 20 commodities, calculated daily by the FreeMark software application within the digicurrency, using a variable oracle-based methodology.

65% of Assets are Held in Audited Escrow

In order to reduce the risk for early FreeMark buyers, only 35% of the Presale proceeds will be used to finance the development of the software, preparation and marketing of the FreeMark ICO. The other 65% will be held in an audited, regulated FreeMark Reserve Endowment Trust as genuine asset-backing for the FreeMark.

The FreeMark Will Protect Against Inflation and Deflation

The FreeMark’s value derives from it being the ideal medium of exchange for international, and local transactions because it protects its savers with very strong inflation and deflation resistance. If the basket of 20 commodities rises in price, the price buyers can withdraw FreeMarks at will be higher than their purchase price, thereby offering strong protection against inflation.

Savers of FreeMark Will Earn a Royalty

The FreeMark is purposely designed to be stable. Therefore savers do not earn a return because the price of the FreeMark rises. Instead, they earn more FreeMarks as the money supply (the amount of FreeMarks in circulation) grows. The FreeMark application automatically pays existing FreeMark owners, according to their average balances, a percentage of a function of the growth rate of the FreeMark money supply. This system is designed to keep the asset-backing of the FreeMark rising annually from the initial 65% towards the full 100% asset-backing, as discussed in the Business White Paper.

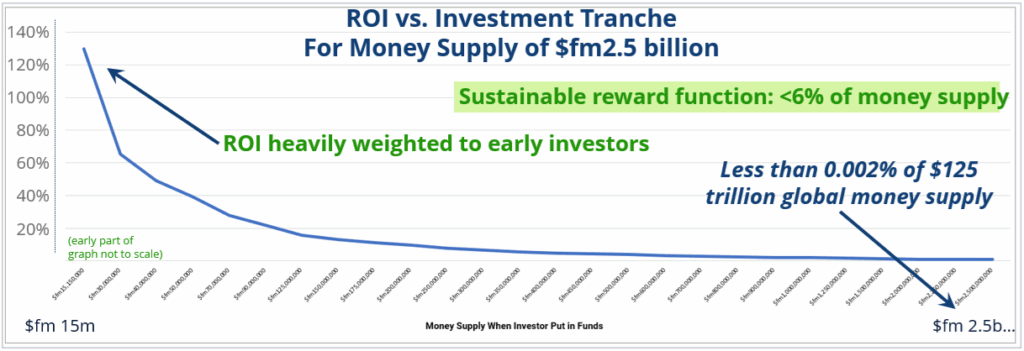

What is the Upside? For early owners/adopters, up to 13Xs or more over 1-3 years, for a venture-scale return

The return a holder of FreeMarks can expect depends upon the growth rate of the money supply. This is the opposite of government fiat currencies, which cause savings to become less valuable when the money supply grows. Instead, the FreeMark saver receives more FreeMarks as its usage expands. Our objective is to complete a launch by the end of the year. With the FreeMark, because it is an asset-backed stablecoin, growth of the money supply is good for savers, not bad. Because the growth rate is higher in the beginning, the early rate of return is higher, as the following three examples show:

Please see the Risk and Reward section below. The upside of purchasing FreeMarks is not guaranteed, but the design of the currency is such that the upside should be achievable.

Launch completed and FreeMark Trading by the end of 2025

Worldfree will endeavour on a best-efforts basis to complete its launch for $25 million, and have the FreeMark application trading and functional as a distributed exchange system by the end of the year.

Cryptocurrencies Are Terribly Inflationary

When they are going down, cryptocurrencies are inflationary—a 10% inflationary decline in value over a day or two is like Zimbabwe or Venezuela. This causes erosion of savings.

Because the FreeMark is stable, an owner can make funds with it if commodity prices in general increase. But the FreeMark also provides a means of gaining more of them, rather than a price increase of each.

Risk and Reward

Practically every attempt to gain a reward entails a risk, which is generally proportionate to the potential reward. Every-day risks such as driving to the grocery store entail risk of life and property through accident, and commonly other normal tasks entail risks to property and person. Financial risks are an unavoidable, daily fact of life for everyone, regardless how prudent an investment or a transaction may seem.

The FreeMark cryptocurrency, because it is a newly developing one, has a higher risk than exchanging your currency for a Euro or a Swiss Franc, for example.

For this reason, the FreeMark digital currency has been engineered to deliver a substantial reward to earlier buyers.

The FreeMark has been engineered to provide a substantial reward as an incentive to utilise the FreeMark as a medium of exchange. That this potential reward has purposely been made available does not make the FreeMark a security, just a different and better type of currency.

To develop and test the system software, Worldfree first must raise the capital to create the distributed currency and its unique economic benefits. Letting early buyers share in the rewards makes sense, but it should not be the only reason people help us create the better global FreeMark business environment.

The FreeMark is a digital currency that Worldfree’s team has endeavoured to engineer to be the very best medium of exchange. The FreeMark is automatically stable in order to:

- reduce the risk when trading volatile assets such as financial securities, currencies or crypto-assets

- facilitate international trade of goods and services between different currencies by lowing hedging and transaction costs and time requirements

- provide inflation and deflation resistance through automatic pegging to a basket of 20 commodities, selected and weighted according to low volatility based upon 6-month moving averages.

It is critical to recognize that individuals with limited financial resources derive greater marginal utility from high-reward investment opportunities, which inherently carry higher risks. For such individuals, the potential for significant returns, such as a tenfold return on investment, holds greater importance than for wealthier individuals who already possess substantial resources. Low-reward investments offer minimal value to those with fewer resources, as the time and effort required to evaluate such opportunities outweigh the modest potential gains, effectively undercompensating them for their efforts.

Early-stage investments represent one of the few rational avenues through which individuals of modest means can meaningfully improve their financial and social circumstances.

When regulatory bodies impose restrictions on less-wealthy individuals participating in high-risk investments, they effectively limit access to high-reward opportunities, thereby impeding social and economic mobility. Such regulations are inequitable and warrant concern. While individuals are permitted to purchase lottery tickets, where outcomes are entirely beyond their control, they are often restricted from developing the skills to evaluate and select promising ventures—a capability that can be cultivated and applied consistently.

By enacting restrictive laws against high-risk investments, governments not only curtail the potential for significant financial gains but also infringe upon the rights of new investors to experience failure and learn from it, thereby hindering their development as competent investors.

In today’s information-rich environment, individuals have unprecedented access to the knowledge and resources of sophisticated investors. This includes participation in investor forums, studying the investment criteria of venture capital firms, attending angel investor seminars, and accessing a wealth of publicly available research. However, to apply this knowledge effectively, individuals require access to low-value investment opportunities that allow them to experiment and gain practical experience.

There is no justifiable basis for presuming that individuals are incapable of educating themselves to become informed investors and making their own investment decisions. It is their capital, and there exists no rational grounds for restricting their economic freedom to pursue such opportunities.

A purchase of FreeMarks includes only the currency units purchased. Any additional promotional bonus is not to be included in the purchase price, but to be considered as a free item as a gift from Worldfree, without significant commercial value.

Volatility Kills the Crypto-economy

Cryptocoins go up and down, sometimes 10% in a few hours. This massive volatility keeps most people from using cryptocurrencies as a practical medium of exchange—it’s too risky.

When the Bitcoin is going up (deflation), fewer owners want to spend it. When it’s going down (inflation), fewer buyers want to accept it.

Risk Factors

An investment in the FreeMark cryptocurrency offered hereby involves a high degree of risk and should only be made by persons who can afford a total loss of their investment.

The sale price is not to be considered a representation that the FreeMark currently has a market value equal to such sale price or that it could be resold at such price. Worldfree expects to have the FreeMark trading on its distributed exchange by the 2nd quarter of 2021, with automatic pegging of the price to a basket of commodities at that time, perhaps sooner, depending upon the outcome of the FreeMark Pre-sale and Launch.

From the time of the Launch onward, the FreeMark will enjoy an automatic pegging of its price to a basket of commodities. In evaluating an investment in the FreeMark digital currency, prospective buyers should consider carefully the following risk factors:

Worldfree (the “Company”) wishes to clarify that forward-looking statements regarding future events or financial performance are inherently uncertain and cannot be definitively deemed true or false until such events transpire. The Company’s management provides these statements based on carefully considered premises, assumptions, and conclusions regarding future developments. It is the responsibility of each investor to independently evaluate the validity of these forward-looking statements. The Company acknowledges that no entity can consistently predict future outcomes due to the multitude of variables involved.

The Company recognizes that investments are inherently future-oriented. Investors seek returns based on future performance, as no reasonable investor would expect immediate returns without regard to future developments. Consequently, investors may desire assurances about future outcomes; however, such assurances cannot be provided, as the future remains uncertain.

Investors are therefore encouraged to exercise their own judgment when making investment decisions. The Company provides forward-looking statements in good faith and on a best-efforts basis. Management has endeavored to identify factors that may cause actual results to differ from current expectations, including, but not limited to, adverse economic conditions, heightened competition, new market entrants, unfavorable government regulations, insufficient capital, unexpected costs, lower-than-forecasted revenues or net income, supply price increases, failure to secure new customers, litigation or administrative proceedings involving the Company or its employees, fluctuations in operating results or financial condition, adverse publicity, challenges in executing marketing or sales plans, loss of key personnel, changes in interest rates, inflationary pressures, and other risks detailed in this or other Company communications.

The Company’s management does not claim to predict the future but strives to analyze past trends, identify emerging opportunities, and understand the fundamental needs of the markets we serve. We present our conclusions, supported by relevant evidence, and invite investors to join us in our dedicated pursuit of a rational and innovative vision for the financial and monetary landscape.

Worldfree is an emerging company focused on raising capital to achieve its strategic objectives and establish itself as a sustainable, long-term enterprise.

The FreeMark is a newly developed cryptocurrency currently in the development phase. Its success as a viable, long-term medium of exchange depends on achieving widespread market acceptance and adoption.

These statements accurately reflect the current status of Worldfree and the FreeMark. Prospective investors and stakeholders are strongly encouraged to thoroughly review the detailed information provided in Worldfree’s two White Papers and additional materials available on the Worldfree website.

In response to evolving market conditions and technological advancements, Worldfree may adjust its planned allocation of funds, modify the composition or compensation of its team, or adapt the proprietary technologies developed to address critical challenges identified by the Company’s team.

Worldfree is committed to executing its plans on a best-efforts basis, leveraging its current insights and adapting to dynamic market conditions and emerging opportunities. The Company’s team is dedicated to creating the FreeMark with the aspiration that it will endure for centuries—a vision that you, as a supporter of the FreeMark, can help realize.

There can be no guarantee that Worldfree will achieve profitable operations in the future. The Company’s management anticipates that Worldfree will incur operating losses until the FreeMark is fully developed and successfully marketed. Future operating results will be subject to a variety of factors, including, but not limited to, the Company’s ability to complete the development of its product line and to manufacture and distribute its products profitably on a commercial scale; the market’s acceptance of the Company’s products; the Company’s capacity to develop, market, or commercialize new products; the Company’s ability to manage growth while maintaining product quality; and the effective execution of its business plan.

As Worldfree is a newly established entity, it has not yet generated historical audited financial statements.

The Company’s capital requirements are influenced by multiple factors, including the rate of market acceptance of its proposed products and services, its ability to maintain and grow its customer base, the resources needed to expand its marketing and sales operations, research and development efforts, pricing and timing of potential acquisitions, and other considerations. The precise timing and magnitude of these capital needs cannot be accurately forecasted.

Should the Company’s capital requirements deviate significantly from current projections, or if the Company is unable to secure the full amount of the proposed offering at the anticipated pricing, additional financing may be required earlier than planned. There is no assurance that such financing can be obtained on favorable terms, or at all.

The Company has begun to sell FreeMarks, yet it is impossible to predict the level of market acceptance of the FreeMark. There can be no assurance that sufficient sales of the FreeMark will sustain the ongoing operations of the Company.

The FreeMark will be sold in this Presale of $fm6 million on a “best efforts” basis. Thus, there can be no assurance that all of the FreeMarks offered hereby will be sold. There is no minimum-offering amount that is required to be sold before the Company may use the proceeds of the Offering.

Thirty-five percent (35%) of the Funds tendered by prospective purchasers will not be placed in escrow, but will be available for use by the Company immediately upon acceptance, for the purposes and in the amounts as estimated under “Use of Proceeds.”

Sixty-five percent (65%) of the funds tendered by purchasers of the FreeMark will be placed in an audited account, to be held as asset-backing, and returned in the event that the Company cannot continue operations at some future date. These funds will be invested in no less than investment-grade securities or interest-bearing accounts, the proceeds of which will provide operating capital for Worldfree to continue its funds raising as necessary.

With successful performance in the Presale and Launch, the 65% funds will be transferred to The FreeMark Reserve Endowment Trust (the “FMR Endowment Trust”), a regulated, audited and professionally-managed Bermuda Trust fund that will be legally tied to providing only the liquidity needs of owners of the FreeMark, and invested in order to provide inflation and deflation resistance. Management fees of 20% on performance, and 2% of the FMR Endowment Trust will be charged on an annual basis to compensate the management of the FMR Endowment Trust. The stated Goal of the FMR Endowment Trust will be to deliver a 4-8% annual real return to the FMR Endowment Trust after fees, on an average basis.

If the Company sells less than the full amount sought in this Presale, it may not be able to accomplish its goals and may be required to seek additional financing, which may or may not be available, or on favourable terms.

The FreeMark venture has other risks, namely:

- Dependence on Key Personnel—Worldfree is highly dependent on the technical and managerial skills of its key employees, including technical, marketing, advisors, and executive personnel, and on its ability to identify, hire and retain additional personnel. Competition for key personnel, particularly persons having technical expertise, is intense, and there can be no assurance that the Company will be able to retain existing personnel or to identify or hire additional personnel. In particular, the Company is highly dependent on the continued services of its senior manager: Kevin AP Kirchman.

- Risks of Technological Change—The markets for cryptocurrency software applications are characterised by rapid technological developments, frequent new product introductions and evolving industry standards. The emerging nature of these products and their rapid evolution will require that the Company continually improve the performance, features and reliability of its FreeMark applications, particularly in response to competitive offerings. There can be no assurance that the Company will be successful in responding quickly, cost effectively and sufficiently to these developments. There may be a time-limited market opportunity for the Company’s software systems, and there can be no assurance that the Company will be successful in achieving widespread acceptance of its products before competitors offer products with performance similar to or greater than the Company’s current offerings.

- Initial Lack of Liquidity—There is currently no established trading market for the FreeMark, although the Companies plan is to establish a distributed exchange for its use in purchasing goods, services, financial securities, as well as its exchange for other cryptocurrencies and currencies in general. As a result, owners of FreeMark must bear the risk as they await the Companies accomplishment of the establishment of that exchange. The FreeMark should only be purchased by persons who have no need for liquidity in their investment.

- Risk of Product Defects—Software products as complex as those to be offered by the Company may contain undetected errors or “bugs” when introduced or when new versions are released. No assurances can be given that, despite testing by the Company, errors will not be found in new products or releases after commencement of commercial operations, resulting in loss of market share or failure to achieve market acceptance. Any such occurrence could have a material adverse effect upon the FreeMark’s marketing, business model, financial condition and results of operations.

To buy other amounts, press “Add to basket” again.